Unlock Ownership Fund accelerates the development of equitable asset ownership through grants and investments. Specifically, the goal is to build wealth in historically underinvested households through home and employee ownership.

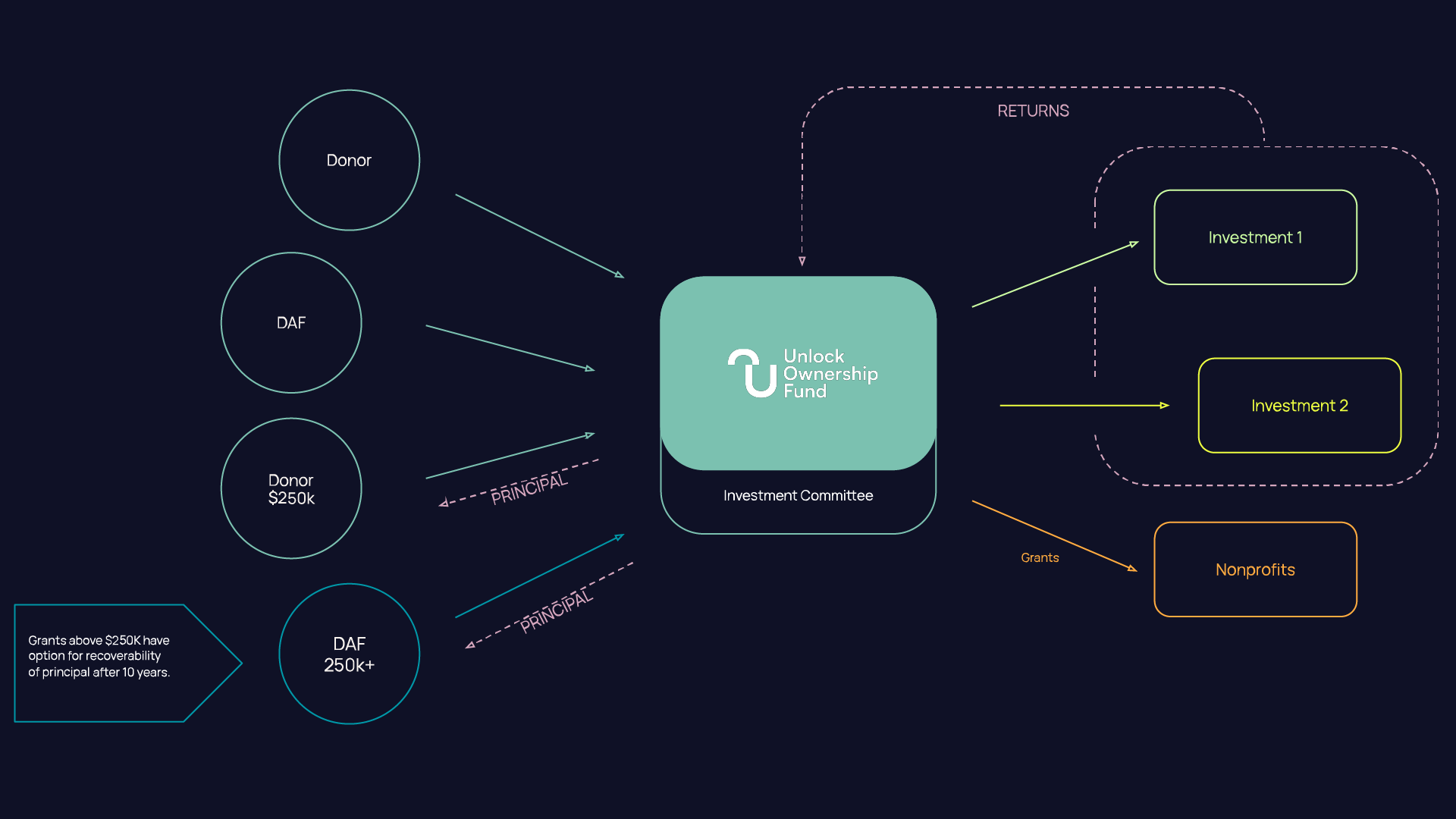

Unlock Ownership Fund makes it incredibly easy for DAF holders and donors to provide catalytic capital to emerging impact investing funds to tackle race-based wealth inequality and improve wellbeing for families.

The fund brings together a growing movement of leaders in the field to ensure that capital is being moved to the places where it can effectively accelerate change.

Managed and implemented by Impact Charitable, the fund ensures the effective deployment of capital to support equitable wealth-building initiatives.

Our investment committee, advisors, and network of partners are closest to the problem.

They identify the places and funds where your catalytic capital will positively drive the highest impact needs of shared ownership.

With our full spectrum capital, you’ll join a community of mission- and impact-focused investors who are ready to take the lead and unlock their investments to unlock ownership.

The Unlock Ownership Fund will invest in initiatives and funds that align with the investment policies established by our committee. The current policies are outlined below:

Investments should be directed towards funds and initiatives that enable wealth creation for people and households. This may include innovative ownership models that provide employees with equity and / or retirement benefits as well as other forms of long-term wealth accumulation such as home ownership and tenant equity vehicles.

Preference will be given to funds and initiatives that explicitly focus on addressing racial and economic disparities in asset ownership. These should demonstrate a clear strategy for empowering historically marginalized communities through asset ownership.

Seeking out funds and initiatives that employ equitable practices in structuring risk and return. This includes models that provide patient capital to allow for sustainable growth and development.

We will prioritize funds and initiatives led by teams with relevant lived experiences. This includes leaders who have first-hand understanding of the challenges faced by the communities they serve and a deep commitment to creating opportunities for wealth creation and empowerment. We value diverse perspectives and will look for teams that reflect the diversity of the communities they invest in, recognizing that this diversity strengthens decision-making and community impact. We do not require previous experience leading funds.

Preference for funds and initiatives that demonstrate a strong commitment to community impact and sustainability. This includes funds that invest in businesses with environmentally sustainable practices and positive community engagement, reflecting a holistic approach to business success.

Does your work align with the investment criteria above? We may be able to accelerate your impact. Fill out our Letter of Interest form today to get started!

We have heard from leaders in shared ownership of the importance of their voices and expertise in ensuring that capital is most effectively deployed to accelerate shared ownership. To that end we are building an inclusive governance model that empowers those leaders to make decisions over the fund.

All grant and investment decisions will be made by an inclusive governance committee of experts, asset allocators, fund managers in the portfolio, and the fund founders. Our governance process and advisers will be refined for launch, periodically updated and shared publicly.

We hope to demonstrate the success of a truly inclusive governance model.

The fund will bring together a growing number of leaders working directly with these solutions to help ensure that capital is being moved to the places where it can rapidly drive impact.

With Unlock Ownership Fund, we make it easy and overcome the usual roadblocks so that your money will effectively address wealth inequality.

As easy as submitting a grant to get started!

The Unlock Ownership Fund uses donations and Donor Advised Fund (DAF) capital to develop more shared ownership investing options. The fund is actively seeking additional mission-aligned investors and donors.

Deborah Frieze is a professor, author, entrepreneur and activist. She is co-author (with Margaret Wheatley) of Walk Out Walk On, an award-winning book that profiles pioneering leaders who walked out of organizations failing to contribute to the common good—and walked on to build resilient communities.

Deborah founded the Boston Impact Initiative, an impact investing fund working to close the racial wealth divide in New England. The fund takes an integrated capital approach, combining investing, lending and giving to build a resilient and inclusive local economy.

Based on her work at BII, Deborah teaches Community-Based Investing to communities around the world, including at Tufts University’s Department of Urban and Environmental Policy and Planning.

She is also founder of the Old Oak Dojo, an urban learning center in Boston, MA.

Katie Boland is the on the Board of Village Enterprise, which aims to end extreme poverty in Sub-Saharan Africa through entrepreneurship and innovation.

She is also the co-founder of The Delta Fund, which makes impact investments and grants focused on poverty alleviation, racial justice, and economic justice. As a member of The ImPact, Katie is passionate about people aligning their capital with their values.

A co-founder of The Delta Fund, Brian is focused on supporting organizations that work to improve equity, poverty alleviation, racial justice and economic justice.

Brian spent over 20 years in digital technology development, where he built high impact teams in strategy, operations, marketing and engineering. He currently serves on the boards for Turn.io and LifeHikes.

Unlock Ownership Fund accelerates the development of equitable asset ownership through grants and investments. Specifically, the goal is to build wealth in historically underinvested households through home and employee ownership.

© 2025 Unlock Ownership Fund

Please note that we are not a registered investment advisor (RIA).

Fill out the form below, and we will be in touch shortly.